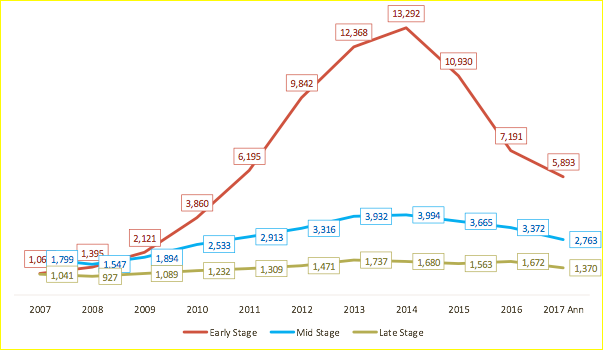

Something strange is happening in the place where two worlds meet: Silicon Valley and Venture Capital. A new trend has emerged where seed-funding for early-stage start-ups is down by 40% based on the number of transactions, since a recent peak in 2015. As reported by LinkedIn, while the quantity of money being spent on early-stage investments has stayed more or less the same, funding has become concentrated in later stage companies, as opposed to fresher start-ups.

Are We Sending A Message To Entrepreneurs That Innovation Is Dead?

Or maybe it has been slowly dying for quite a while. Remember the time when Bell Labs had such a surplus of capital they funded all sorts of random science projects that spun off into tremendous businesses and industries, take 3M for example. Is this innovation still happening in techvalley or the up and coming pockets of innovation like Brooklyn?

Can you still empower start-ups to scale with limited access to funds, especially in industries where engineering talent required to create world-class technology for businesses or production operations and market penetration costs are steep? Is it the early-stage investments that allow fund and product managers and VCs to interpret the passion and dedication of entrepreneurs and their daring new ideas to tackle stubborn, strong market-tested products that have already proven their ability to scale globally?

Risk-averse VCs and angel investors, as well as several other contributing market factors means it is harder to get off the ground floor. While we all know crowdfunding has taken a small piece of the large market, it inherintly has more risk due to its structure. But while the trending, Cyber-token crowdfunding might have sounded like a scam back in 2016, two years have made quite the difference! A lot can happen in a couple of months when it comes to technological advancement. Now two years have gone by, Bitcoin has roared to prices nearly passing $20,000, and cryptocurrency is continuing to grow despite the initial response. Techies who made several hundred or thousand dollar investments are now sitting on millions of dollars worth of cryptocurrency, while the sector is still relatively in its infancy.

Innovation Where It’s Least Expected

If cryptocurrencies and altcoins were for the most part invented those opposed to regulators, governments, big commercial banks and central banks, how will ICOs ever be able to be regulated? These ICOs, Initial Coin Offerings, can assist to crowdfund start-ups and potentially boost local innovation but with that potential also comes a potential to cheat and scam. Plus with the decentralization of these currency systems via the blockchain, it becomes impossible for a central authority to reverse fraudulent transactions. But before we completely disregard this new technology for fear of change or lack of understanding, it may make sense to take another look at this technology which has the potential to not only revolutionize investments and currency, but the way all centralized systems are operated in the future!

Are ICOs actually the democratization of fundraising? Possibly, but with Angel investing, VCs and Kickstarter-style crowdfunding — start-ups still need more legitimate alternatives to raise capital, quickly, and easily while still protecting investors. Startups will need to locate investors and in ways that align with their values, in order to construct the companies of tomorrow, and ICOs offer flexibility that could be the solution. Change can be very difficult, but progress for the sake of progress can be dangerous itself.

How Do Initial Coin Offerings (ICOs) Work?

Start-ups launch an ICO by issuing cryptocurrency tokens on the blockchain and supply early investors an opportunity to acquire these tokens, in exchange for cryptocurrency — there are different pros and cons. But how will the legal classification of ICOs and these crypto-tokens evolve? They resemble aspects of crowdfunding as well as IPOs, but have more potential for unethical things to happen? At the same time regulators have been caught off guard, struggling to classify the tokens. Are they currency? Are they equity? Recently the general rule allowing ICOs without formal registration is if the tokens have a use now then they are fine as a cryptocurrency. If they are worthless and useless now, then they act as an investment vehicle which falls under state and federal regulations in the United States and around the world.

But that’s the interesting part that many seem to overlook. ICOs, their tokens and coins and blockchains are completely global. No borders, which makes regulations even more difficult. That brings us back to the point that they were designed to be decentralized, and avoid regulation all together which has somewhat worked with one major exception the BitLicense regulation requiring businesses in New York to register should they wish to conduct business in cryptocurrency. This and other uncertainties has resulted in many cryptocurrency exchanges backing out of serving not only New York Residents but United States Residents all-together.

Built-In Open-Source Auditing

Many blockchains build reputation for fairness by allowing anyone to access and view their ledgers, stored on the blockchain, helping to make investors feel a bit more comfortable. But together with the unregulated nature of the blockchain itself comes new interactions and possibilities with the blockchain, that have already begun to spur further innovation at a time like today, where early-stage financing and investment is much harder to find than normal. Based on where your early-stage start-up exists, this may be a substantial barrier to entry to becoming a successful entrepreneur.

Should we rely on innovation like blockchain and ICOs, to fuel the next evolution of businesses, technology start-ups and others? Do we need very precise and transparent but overarching rules to allow it to happen? Or do the designers, coders and inventors of each new token and coin truly have the public’s best interests in mind, striving to become the best in use, not the best to use and abuse? If we look at the Bitcoin trend and the opportunities it has already provided, perhaps the industry will continue to do a good job of regulating itself. Keep in mind, most if not all of these cryptocurrencies and their blockchains are open-source, allowing anyone access to review, reuse and repurpose their code, but also to check for hidden backdoors or malignant features meant to swindle the uneducated investor?

Is Regulation Needed For Transparency?

If we look at all the major cryptocurrencies, the blockchain is all about transparency and is creating new methods of building trust and consensus, while being able to scale. And scaling is a must if startups and the finance world are to truly benefit from them. Systems that cannot handle high volume transactions will likely end up hurting startups more than helping. If an ICO appears to be a childish money making strategy to people in finance, but on the other hand a few entrepreneurs have used ICOs as a tool to grow their business to another level, how do the blockchain and VC community come together to stabilize this new kind of crowdfunding?

Straight Talk About Investments

The simple fact is Angel investments for early stage start-ups and the whole funding landscape has changed significantly and stumbled over recent years. That is bad news for grow-or-die stage start-ups that have considerable exposure and danger to fail, yet on the other hand, ICOs themselves have been growing and multiplying at incredible rates. Why isn’t this way of crowdfunding hitting the mainstream of international start-up communities? There seems to be alot of deeply rooted animosity amongst traditional finance and the world of cryptocurrency, for if crypto is left alone to grow, it may totally change the wealth distribution and thus power distribution in the world.

Initial coin offerings have increased $1.2 billion and today transcend early stage VC financing

(Source: CNBC, as of August, 2017).

ICOs have become more recognized and when the existing Venture Capital landscape is still risk-averse, ICOs will become legit ways of start-ups to live, and a couple of them will flourish! Hedge Funds have begun to emerge investing soley in ICOs and cryptocurrency both on the hardware mining side as well as the “Buy & HODL” strategy, as it is called in the industry. (Buy & Hold) Startups will have the ability to raise money by selling investors tokens in exchange for equity, like an initial public offering (IPO) and have a vote on their future leadership but the true opportunity lies in the ability for the blockchain to revolutionize all systems and markets that are centralized, lowering costs, removing middlemen, and giving access to Main Street investors to those investments reserved in the past for only Wall Street. The balance shifts even more, but maybe that shift is necessary after all the artificial manipulation our financial systems have gone through over the years. Could cryptocurrency be the natural answer to solve the never ending QE?

Who’s Winning?

Some indicate the largest winners of ICOs are in fact seed investors themselves. Nevertheless this stuff is still relatively new. Despite Bitcoin being around for a decade, much of the innovation and enormous growth of new currencies, altcoins and blockchain features has occurred mostly in the last 12 to 18 months. It seems like it was only yesterday in 2013 once the first ICO began with Mastercoin’s beginning ICO. In many ways the regulatory examination is murdering the excitement, and even the possibility of ICOs on a legal foundation. Cities that value innovation, might need to consider the facts and see the massive potential for start-ups in ICOs and the greater value the technology can have on humanity as a whole as we evolve at ever faster rates.

However, because ICOs create the chance for start-ups to market a token that is an asset to prospective employees, developers, investors and users; it’s a lot more fluid and “collaborative” compared to Angel investors, a Kickstarter or anything truly resembling an IPO-model. The token that’s generated in the ICO is a new type of strength, not necessarily an equity. No longer would there be equity diluted from future rounds, the equity holders prior to the ICO get all of the benefit, and so, there might be a win-win here that empowers start-ups financed via ICOs a sneaky edge over their old-world competitions.

What Happened To All The Early Phase VC Funding?

The implosion of early stage VC financing could be what was required for ICO crowdfunding to make its move into acceptance. Consider it, where better would the future of innovation come from then through the trust recommending blockchain? Between unregulated crypto bubbles and a mad race to BTC futures (derivatives), it is make or break time for the BitCoin insanity. Whether the BTC futures markets can even impact the BTC Blockchain and its prices is still up for debate. Regardless, if we continue down this road we are probably seeing a new type of crowdfunding and a new path to entrepreneurship. And that growth in entrepreneurship excites me for it invites innovation!

We’re seeing new technologies and blockchain experiments which are creating new jobs and new ways for new businesses can thrive and may even provide a bridge, or a shortcut to getting true Venture Capital Financing once demand is shown via ICO.

Since 2014, the amount of VC rounds in technology companies worldwide has nearly shrunk in half from 19,000 that year to 10,000 in 2017. While the amount of money being invested has remained more or less steady, funding has concentrated in later stage companies, away from newly-minted startups. There are a number of possible reasons for this: the popping of a seed funding bubble during the shift to mobile, the movement away from funding apps, Fintech and SaaS startups, and increasingly risk-averse angel investors. Source: LinkedIn.

Why we are not talking about this more is beyond me? That is a complicated question to ask, but we will in complicated times.

As the degree of diligence in the seed stage appears to have increased significantly over the last couple of years, at precisely the exact same time, we have seen the growth of ICOs and blockchain innovation. Regulation of the blockchain has to be cautious not to curtail the positive effect it could have on democratizing innovation itself.

It may be the wild west of ICOs and more case studies of start-ups who produce win-win scenarios for themselves and their investors with this new wave of technology, yes ICOs could very well play a growing role as a proposed alternative to the early stage start-up funding world.